By Costas Efimeros

Please note that Thepressproject is still trying to offer high quality investigative journalism under very difficult circumstances. Paypal will not accept money transferred from within Greece. Now, more than ever, we need our international readers to support us. Read why

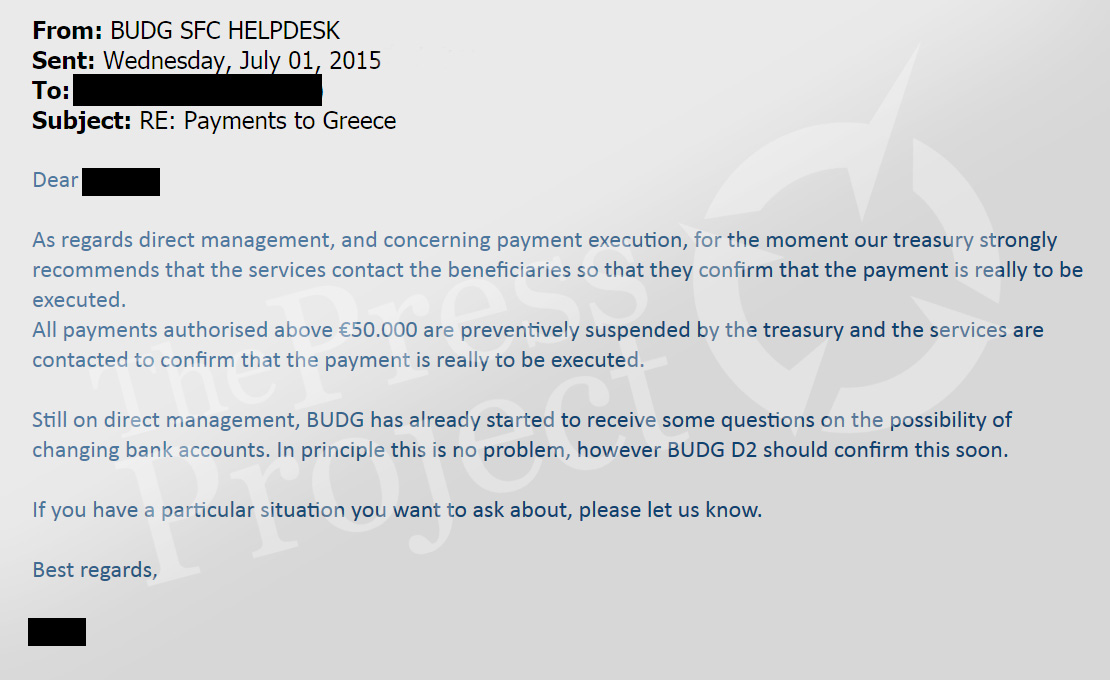

The document that we are presenting is an internal email held on an internal server of the European Commission; the email reached our hands from Brussels. The message was forwarded to the Helpdesk of the DG-BUGD (Directorate General for the Budget) of the European Commission and in it instructions are given for payments into bank accounts held in Greece.

Specifically, the email states that “As regards direct management, and concerning payment execution, for the moment our treasury strongly recommends that the services contact the beneficiaries so that they confirm that the payment is really to be executed. All payments authorised above €50.000 are preventively suspended by the treasury and the services are contacted to confirm that the payment is really to be executed”. It continues: “All payments authorised above €50.000 are preventively suspended by the treasury and the services are contacted to confirm that the payment is really to be executed.”

But still more shockingly, according to this piece of information, the General Accounting Office of the European Union approves in principle the payment of sums into other bank accounts, i.e. accounts held outside of Greece. This amounts to an unprecedented bolstering of tax evasion, as the EU is showing itself willing to send NSRF monies and wages of Greek beneficiaries to banks outside of Greece.

Thus the European Commission, at the same moment that it is presumably worrying about the liquidity of the Greek banks, is depriving those banks of milions of euros which could be helping milions of Greek citizens who are being forced by the ECB’s decision to stand in lines to withdraw 50€ a day.

Regarding the 50.000€ limit mentioned in the message, at a time when rumors of a haircut for Greek deposits are rampant, it makes us wonder if a YES this Sunday can have any significance in the end. For as we discovered in the case of Cyprus, the political will of the people is of no consequence for technocrats who take only numbers into account, and ignore the lives and living standards of the citizens.

Two months ago, ThePressProject made public a stunning document which indicated that the Cypriot crisis wasn’t entirely unexpected. For months the ECB had been planning the course of developments which, miraculously enough, was later realized to the letter. At that time the ECΒ not only decided on the future of the Cypriots; it also very well readied the future of a Greek banker who bought billions of euros in deposits for a mess of pottage.