The report, ‘Policies and Prospects for the Greek Economy,’ is the latest in a series of annual reports by the Levy Economics Institute based on figures from the Hellenic Statistical Authority (ELSTAT), the Bank of Greece and Eurostat and using a model developed by the think tank called the ‘Levy Macroeconomic Model for Greece’ or LIMG.

The most recent data bear out a number of previous projections by the group including that the unemployment in Greece would increase throughout 2013. The authors make clear that they believe such negative trends will continue if austerity driven policies continue to be pursued by Greece and its lenders who they accuse of willful blindness when it comes to the demonstrable failure of Greece’s alleged rescue.

According to the introduction of the report, “The latest announcements from Brussels, Frankfurt and Berlin proclaim the worst of the Eurozone crisis to be over, and even praising Greece for having finally turned the corner. Surprisingly, they must be neither observing the recent economic developments nor the narrowing of the country’s policy options.”

The authors draw particular attention to the goal of reducing the debt to deficit ratio – one of the key targets of Greece’s rescue program. To say that this target has been missed is a wild understatement given that rather this ratio having been reduced, it has actually grown under three years of austerity. As the report states,:

“Despite its spectacular failure for more than three years now, the goal of a decrease in the debt to GDP ratio has been likened to chasing a mirage as the recent level of 175 percent testifies, especially, if one considers that this ratio was about 125 percent at the onset of the crisis four years ago. And this, prior to any “rescue” from the country’s lenders and even after the world’s highest debt “haircut” in 2012 (Papadimitriou 2013a).”

According to the report Greek government debt as a percentage of GDP will continue to rise in 2014 and reach 208% in 2015.

Unemployment

The report notes the rise in unemployment which continued in 2013 with another 84,128 individuals joining the ranks of the unemployed which reached an all time high of 1,387,500 individuals. Even in relatively robust sectors the report notes signs of weakness. For example while the “Accommodation and food service activities” sectors added 50,800 salaried employees between the first and third quarter of 2013, at the same time the number of employers in the sector fell by 1,900, indicating that large businesses are increasing in size at the expense of smaller restaurants, cafes hotels etc. Furthermore, despite the much trumpeted increase in summer tourism in 2013 the sector actually employed 9,300 fewer people than in 2012.

Internal Devaluation

The report also makes clear that the Troika’s strategy of increasing the competitiveness of the Greek economy by reducing the cost of labour is misguided. While real wages have fallen by almost 30% since 2010, this has had little if any impact on Greece’s exports.

While the trade deficit has closed from its pre-recession peak, this has been largely due to an 18.8 billion euro decrease in imports rather than the small, 2.7 billion increase in exports over the same period. Furthermore the report claims that the improvements in exports is entirely due to oil related products exported primarily to non-Euro countries while exports of services and non-oil related products have not yet recovered to their pre-crisis levels. As such the improvement in Greece’s trade deficit is dependent on the price of oil related products.

As such the authors state, “the improvement in Greek exports has nothing to do with competitiveness achieved through wage deflation, since it is related to trade with non-Euro countries, especially with a strong Euro compared to the U.S. dollar, and concentrated in oil-related products that increased in price … To be sure, the increase in exports in oil-related products is beneficial in the short term, but the country becomes vulnerable to fluctuations of oil prices, and provides a minimal stimulus on job creation and growth.”

The IMF is wrong

What the reductions in wages has achieved is a dramatic drop in living standardds and domestic demand which is ‘the most important stabilizing driver in an economy’.

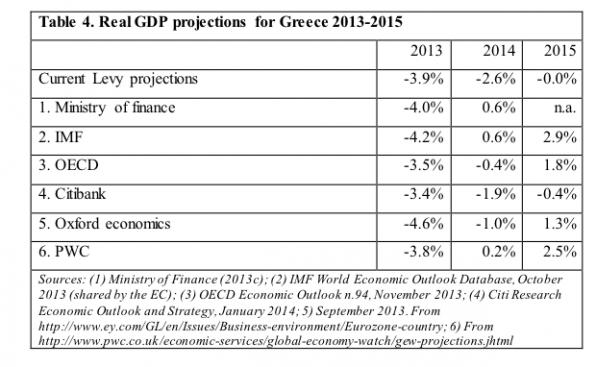

From their analysis the Levy Institute economists come to notably different conclusions than both the Greek government and the IMF.

Given that the fall in wages has not been accompanied by an similar fall in prices, domestic demand is expected to remain low. This means that, “..it is inconceivable to expect that investment will be increasing by 8.4 percent, as the IMF is predicting.”

The IMF’s and government’s projections regarding Greece’s return to growth in 2014 are also excessively optimistic according to the Levy Institute, which is instead projecting a continuation of the recession in 2014.

The Geuro

As they have in the past, in their report the Levy Economics Institute analysts explore alternatives to austerity that they maintain would allow Greece to emerge from the vicious cycle of austerity and a depressed economy. While the authors believe that a new Marshall-type plan of direct fiscal stimulus for Greece or a freeze on Greece’s debt payments would be ‘economically feasible’ providing a way out of the crisis for both Greece and Europe, it lacks the ‘necessary political will.’

The only option therefore for Greece, the authors conclude, is the creation of a ‘parallel financial system’ – ie the country effectively printing its own currency through the issuance of new ‘Geuro’ bonds without leaving the euro. This, the report states, would allow the government to launch a public benefits employment program, alleviating the suffering of a wide swathe of the Greek population, boosting domestic demand and beginning the repair of the damages suffered by the small Greek industrial structure which are ‘similar to the effects of a major war’.

While there are many questions about exactly how such a system would work, the authors conclude, “What we can clearly observe now is that the harshness of the continuing fiscal consolidation measures in Greece shows no convincingly visible signs of a “light at the end of the tunnel.” While Brussels, Berlin and Frankfurt, with no Greek representation, debate secretly what they should do with the country’s controversial bail-out program Greece should begin considering alternative options in exiting the crisis.”