By Costas Efimeros

The Deferred Tax is not even deferred, not even a tax. It’s a case where the meaning has been reversed. The sort of meanings we have become accustomed to in these times of the memorandums.

What actually was voted through in parliament was the complete exemption of banks from the obligation to pay tax on their profits over the next thirty years. The profits for banks is estimated at roughly €10 bln.

What is deferred tax?

The law stipulates that the amounts bank will save can be recorded in their balance sheets as capital. In other words, banks can have a double gain because, on the one hand, they don’t have to pay the state taxes and, on the other, they show increased capital capabilities, which include the savings of Greek citizens,reducing, in this way, the need of shareholders to opt for share capital increases. Let it be noted, that capital holdings are used by banks as guarantees to secure low interest loans from the European Central Bank (ECB).

In other words, these sums, which they will not have to give to the Greek people, will be used to secure the availability of fresh money. However this, actually, innovative financial trick, introduced by the law, serves as a guarantee for the Greek state-sector. In simple words, the state guarantees that the banks will be profitable over the next 30 years and undertakes the responsibility to provide capital, in cash, in case the banks don’t make it.

Because of the Deferred Tax and the recapitalisation of banks with the money of Greek citizens, the three banks that had problems with the basic scenario of the bank stress test looked better-off in the worst case scenario.

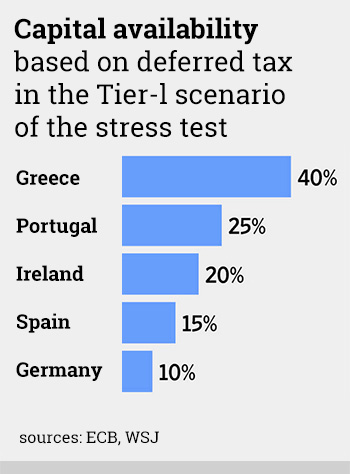

However, it’s worth examining the graphic (inset left): According to information made public by the European Central Bank, in the basic scenario of the stress tests, 40% of the capital of banks is covered by the deferred tax. Simply put, almost half the money that is supposedly found in our bank coffers is….zilch.

However, it’s worth examining the graphic (inset left): According to information made public by the European Central Bank, in the basic scenario of the stress tests, 40% of the capital of banks is covered by the deferred tax. Simply put, almost half the money that is supposedly found in our bank coffers is….zilch.

The percentage in Portugal is 25% while in Germany it’s just 10%. This is in answer to Gikas Hardouvelis, who claimed, during the parliament vote on the amendment, that the same strategy is followed elsewhere in Europe, even in Germany.

We must first congratulate the person who formulated the bill on deferred tax. Our banks would have most likely collapsed in the stress tests, if we had not handed them another €10 bln through the back door.

Finally, it should be noted that the Deferred Tax covers only the losses banks incurred because of the PSI, and not the losses incurred by pension funds or small bondholders. They, most probably, will have to pay their taxes over the next 30 years.

PWC as legislator

The law was formulated -against common sense and common practise – by PriceWaterhouseCooper, with an order by Gikas Hardouvelis, already by the beginning of July.

The move appeared strange at the time, and according to reports, back then, there were negative reactions because finance ministry’s financial and legal services were completely sidelined.

A report by Thanasis Koukakis in in.gr (link in Greek) mentions that finance ministry services had already prepared a law that was ignored by Hardouvelis, and never forwarded to the ECB an the European Banking Authority (EBA) as is the normal the procedure.

Gikas Hardouvelis had his reasons to prefer PwC, the accounting/auditing firm.

Well, of course he did, as a former senior-ranking official at Eurobank, he would have definitely known about the relationship the bank had with the American auditing firm. He may have even picked up that PwC had set up a network to provide tax ‘relief’ to EFG Group, the parent company of Eurobank, which is controlled by the powerful Latsis family.

We, for our part, we had to wait for the revelations made by ICIJ (The International Consortium of Investigative Journalists) before we could examine the PwC files on Eurobank.

If we were to assume that Gikas Hardouvelis had no knowledge of the network PcW had set up on behalf of Eurobank, then we would be right to expect that the Greek state would have already checked to see whether the company, commissioned to formulate the Deferred Tax law, had

- a conflict of interest because – at the same time, it represented a bank which stood to gain handsomely from the new legislation.

and whether

- it should prosecute a company that advised a bank, that had been rescued with the money of the Greek people, on how to avoid paying taxes in our country.

Besides, after reading the details of the bill, it is clear that PwC found its clients a permanent structure to legally tax evade for another 30 years, and indeed, without having to rush to rainy Luxembourg