Α ‘Global Wealth’ report compiled by Credit Suisse suggests that the inequality gap between the country’s rich and poor has widened significantly between 2007 and 2014, largely overlapping with 5 years of ΄reforms΄ imposed by the country΄s lenders

Inequality in Greece has accelerated in the past seven years, according to research published in the Credit Suisse Global Wealth Report last week and The European Union Statistics on Income and Living Conditions (EU-SILC). The timeframe of the change in inequality might suggest this is the result of harsh austerity policies imposed on Greece by international lenders.

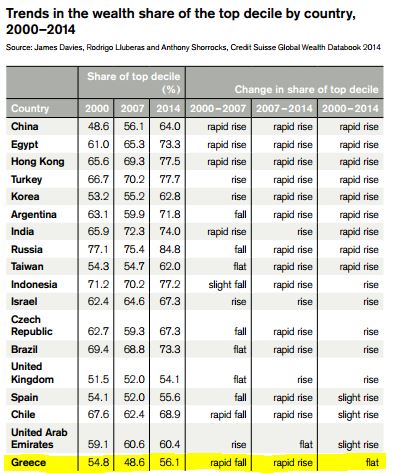

In 2014, the country’s richest 1% own 56% of the country’s wealth, up from 48% in 2007. The country’s debt crisis erupted in the end of 2009; the implementation of the troika-led policies began in May 2010. The Credit Suisse reports describes this as a ‘rapid rise’ in inequality compared to a ‘rapid fall’ in the period stretching from 2000 to 2007.

At the same time the EU-SILC research – whose data is used to monitor poverty and social inclusion in the EU – Greece’s middle income earners have been hard hit with average incomes plummeting to €698 from €915 in the space of just three years (2010-2012).

The risk of of poverty or social exclusion in the same period has risen to 35,7% from 27,7% while, according to the Indicator of Material Deprivation, 37,3 % cannot afford to pay for 3 out of 9 items ‘necessary for an adequate life’ compared to 24.1% in 2010 when Greece signed its first bailout agreement.

The rate of material deprivation -is an indicator pf the EU-SILC that expresses the inability to afford some items considered by most people to be desirable or even necessary to lead an adequate life.

In 2013, a UN expert on debt and human rights, Cephas Lumina,. told the Kathimerini newspaper that there had been “an estimated 25% increase in the country's homeless population since 2009” and the poverty rate for under-17s was close to 44%. “Adjusted for inflation and using 2009 as the fixed poverty threshold, more than one out of three Greeks (38%) had already fallen below the poverty line in 2012,” he told the paper.

Greece’s economy has shrunk by 25% since 2008, but according to financial analysts, it is on target to run a primary budget surplus in 2014 before interest payments for the second successive year.