By Zsolt Darvas and Pia Hutti

The Greek debt reduction issue has been put back on the table as the 25 January 2015 parliamentary snap elections are approaching. Already in November 2012, Eurogroup conclusions stated that “Member states will consider further measures and assistance … if necessary, for achieving a further credible and sustainable reduction of Greek debt-to-GDP ratio, when Greece reaches an annual primary surplus, as envisaged in the current MoU, conditional on full implementation of all conditions contained in the programme.”

Since Greece achieved a primary surplus of 2.7 percent of GDP in 2014 (which is expected to increase further in 2015), and there are uncertainties related to the future debt trajectory of Greece, the Eurogroup could consider further measures, irrespective of which party will win the elections, as long as a comprehensive agreement on fiscal, structural and economic policies can be reached between the Troika and the new Greek government.

European lenders have already made several concessions to help Greece service its debt, such as lowering the interest rate that Greece has to pay, extending the maturities of loans, passing on to Greece the profits made by the ECB and national central banks on their Greek government bond holdings and deferring interest payments to the European Financial Stability Facility (EFSF) loans by 10 years.

Contrary to many press commentaries claiming that European lenders have already made losses on their loans to Greece, this has not yet been the case: with the concessions, so far only the profits of euro-area partners have been reduced.

So what options could be considered to support public debt sustainability in Greece, which would not lead to a direct loss for European lenders? In this blog post we will try to answer this question and calculate the net present value gains for Greece.

While we conclude that there are such options, a reduction in the net present value of debt servicing costs does not mean that more money is available now for Greece to spend.

The reduction means that future debt servicing costs are reduced compared to the current baseline during the next decades and, therefore, Greece would have to spend less on financing its debt in the future.

Option 1: Reducing the lending rate on the Greek Loan Facility

In May 2010, under the first financial assistance programme, euro-area member states (except Slovakia) provided bilateral loans to Greece, of which €52.9 billion was disbursed. The initial maturity of the loan was 2026 (with a grace period up to 2019 and gradual repayment during 2020-26) and the initial interest rate was linked to the 3-month Euribor with a 300 basis point spread during the first 3 years and 400 basis points afterward.

In 2011, the spread was cut to 150 basis points (retroactively) and on 27 November 2012 the spread was cut to 50 basis points. The maturity was extended by 15 years to 2041 with gradual principal amortization between 2020 and 2041.

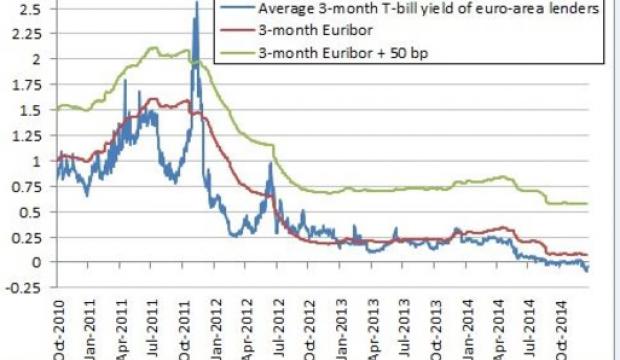

Figure 1 shows the 3-month Euribor rate, the current Greek lending rate (3-month Euribor + 50 basis points) and the average 3-month Treasury bill rate of euro-area partners, which represents the funding costs of the lenders. The figure shows that most of the time, the average Treasury bill rate of lenders was around or even below the 3-month Euribor rate.

Therefore, euro-area partners are making a profit (at least on average) from the Greek Loan Facility, meaning that the spread over the Euribor could be set to zero instead of the current 50 basis points, without incurring losses on average.

However, for certain periods, some lenders had higher 3-month borrowing costs than the 3-month Euribor. For example, on 2 January 2015 the Euribor was 0.076 percent, while the 3-month Treasury bill rates of Portugal (0.124) and Malta (0.144) were larger. For all other countries, including Italy and Spain, the Treasury bill yiled was below the Euribor rate.

To ensure that no country makes losses but also that no country makes profits, we suggest setting up a fund which would collect Greek interest rate payments and pay each country exactly the incurred 3-month borrowing cost. Since the average borrowing cost was below the 3-month Euribor most of the time and will likely stay below it, some funds would even accumulate, which could be passed on to Greece when the loan facility expires.

Figure 1: The Euribor and the weighted average Treasury bill yields of euro-area lenders in the Greek Loan Facility, 14 October 2010 – 5 January 2015 (Daily data)

Notes: we calculated the weighted average of 11 of the 14 euro-area countries participated in the Greek Loan Facility (we left out Cyprus, Luxembourg and Malta due to lack of data), weighted by the volume of the loans they disbursed to Greece. Source: authors’ calculation using data from Datastream.

We calculated the net present value gain during 2015-2050 from reducing the spread over the Euribor from 50 basis points to zero, which is €6.4 billion, or 3.4 percent of 2015 GDP. This implies that Greece can save 3.4 percent of GDP in gross financing needs (in total during the next 35 years) if euro-area lenders forsake the profits they make on the Greek Loan Facility.

Option 2: Extending the maturity of the loans in the Greek Loan Facility

As said above, the final maturity of the Greek Loan Facility was extended to 2041 in the 2012 Greek debt deal. We simulated the impact of a further 10-year extension, whereby both the grace period and the final maturity is extended.

This could delay Greece borrowing from the market to repay the loans under the Greek Loan Facility by 10 years and since Greece would likely have to pay a much higher interest rate on market borrowing over that period, it could save a lot on interest payments. Given our assumptions on interest rates (see Annex), a 10-year maturity extension would reduce the net present value of interest costs for Greece by 4.5 percent of 2015 GDP.

The extension would not cause any direct loss to the euro-area lenders, since they would continue to pass on their lower borrowing costs to Greece throughout the extended maturity. The only negative side effect for lenders would be that their own gross public debt would be higher due to the 10 year extension of maturities.

Yet, public debt and deficit related to euro-area financial assistance programmes is not counted in the debt and deficit measures considered in the European fiscal requirements.

Option 3: Extending maturity of EFSF loans

Over the course of the second financial assistance programme, Greece has so far borrowed €141.8 billion, while the disbursement of a small additional amount (€1.8 billion) is still pending. The average maturity of these loans is already over 30 years with the last tranche expiring in 2054. Greece only pays an approximate 1 basis point surcharge over the actual EFSF borrowing cost.

Therefore, the EFSF lending rate to Greece cannot be reduced further without incurring losses to the EFSF, and thereby to euro-area partners. However, the maturity of the loans can be further extended. We again simulated the impact of a 10-year extension. Similar to option 2, the main benefit accrues from the low-interest rate borrowing, as Greece would not need to rely on the more expensive market borrowing until later.

The net present value benefit of a 10-year extension to Greece would be 8.1 percent of 2015 GDP, while again, the EFSF would not suffer any loss, since it would continue to pass on to Greece its actual lower borrowing cost plus a 1 basis point surcharge throughout the extended maturity.

We also calculated the combination of the first three options, which would amount to a net present value benefit of 17 percent of 2015 GDP for Greece (Table 1). This value is slightly larger than the sum of the three individual effects, because they reinforce each other.

Table 1: Net present value benefit for Greece from three options that do no cause a direct loss to euro-area lenders

| € billions | % of GDP | |

| 1) Zero spread instead of 50bps on bilateral loans | 6.4 | 3.4 |

| 2) 10-year maturity extension of bilateral loans | 8.4 | 4.5 |

| 3) 10-year maturity extension of EFSF loans | 15.1 | 8.1 |

| Combination of 1&2&3 | 31.7 | 17.0 |

Source: Our calculations (see Annex).

Option 4: Buying-back the Greek government bond holdings of the ECB and National Central Banks

Some media reports suggested that Greece could take a loan from the European Stability Mechanism (ESM) and use this money to buy back the bond holdings of the ECB, which it acquired through the Securities Markets Programme (SMP). It was suggested that since the ECB’s bond holdings have higher coupon payments (about 5 percent per year), while the ESM loan would be granted to Greece with an interest rate of about 1 percent per year, Greece could save some interest costs.

But this is not correct: in fact, the ECB bond holdings (as well as bond holdings of national central banks acquired even before the SMP) constitute an interest-free loan to Greece.

The reason is that the Eurogroup decided in 2012 (see here and here) to hand over the profits from the ECB’s Greek bond portfolio, acquired during the SMP, as well as the profits from national central banks’ Greek bond holdings, to Greece.

This applies to both the capital gains (the ECB purchased Greek bonds under the SMP well below face value, while Greece pays back the ECB the full face value) and the interest income.

Table 2 below shows that such transfers lowered

Greece’s financing needs by €2.7 billion in 2013, while the expected transfers to Greece in 2014, 2015 and 2016 are €2.6 billion, €2.0 billion and €1.7 billion, respectively. The decline in the transfers reflects that bonds held by central banks gradually mature and therefore the outstanding stock is reduced.

Therefore, buying back the remaining Greek government bond holdings of the ECB and national central banks would not lead to any gain, but would, by contrast, increase the overall debt servicing costs for Greece.

Source: 5th review on Greece, IMF, Table 14 on page 56, June 2014; Note: * = projected; ANFA = The ANFA holdings are holdings by the Eurosystem national central banks (NCBs), which hold Greek Government bonds in their investment portfolio. See here a brief letter by President Draghi explaining these ANFA holdings. SMP =Securities Markets Programme.

Table 2: ECB related income of Greece from the Greek government bond holdings of Eurosystem central banks (€ billions)

| 2013 | 2014* | 2015* | 2016* | |

| ECB related income | 2.7 | 2.5 | 2.0 | 1.7 |

| ANFA | 0.6 | 0.5 | 0.5 | 0.6 |

| SMP | 2.1 | 1.9 | 1.5 | 1.1 |

Option 5: Swapping the currently floating interest rate loans to fixed rate loans

Some media reports also suggested that Greece could swap its floating interest rate loans (Greek Loan Facility, or even perhaps the EFSF loans) to fixed rate loans.

However, if such a swap is conducted at market rates, it would not reduce the net present value of the expected debt servicing costs, without a counterparty making a loss In fact, the operation could lead to an increase in Greece’s debt servicing costs, because the interest rate of a fixed-rate loan may include a term premium over a floating rate loan.

Certainly, if the swap is conducted at an off-market rate sponsored by euro-area lenders, then Greece would benefit, but in this case euro-area lenders would make a direct loss.

Option 6: Swapping the current loans to GDP-indexed loans

The option of swapping current loans to GDP-indexed loans was also raised. There are many different ways to specify a GDP-indexed loan. Both the interest rate and the principal could be linked to GDP. In fact, in 2012 one of us proposed to index the principal of the loans to Greece to a nominal GDP baseline, but this proposal served as an insurance against unexpected negative shocks to GDP and not to reduce the net present value of Greek debt.

If GDP indexing does not lead to an expected loss to euro-area lenders, then it would also not lead to an expected reduction of net present value of Greek debt servicing costs.

Option 7: Pre-privatisation using European funds

Finally, inspired by the 2011 proposal of Roland Berger, European institutions, such the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD), or even perhaps a newly set-up fund could purchase certain Greek state-owned enterprises, prepare them for privatisation and privatise them later. The World Bank may also get involved, as well as the ESM in buying Greek banks’ shares.

Thereby, Greece could bring forward future privatisation revenues, which would reduce its borrowing needs and interest payments (though it may reduce the dividend it received from the companies concerned). Furthermore, an international consortium may be more efficient in restructuring the state-owned assets than the Greek authorities.

While we are supportive of such pre-privatisation transactions, the major difficulties with this proposal relate to the uncertainties concerning the volume of assets suitable for privatisation, the fair value of these assets and the time and costs involved in preparing these assets for sale.

Therefore, while such a transactions would make sense and could be organised in a way which leads to net benefits for Greece without leading to losses for Euro-area partners (and the EIB, EBRD and World Bank if involved), due to the difficulties mentioned, this is not a proposal which could be agreed upon in the near future.

Overall, among the seven options we considered, the first three could lead to about 17 percent of GDP net present value benefit for Greece, without losses for euro-area creditors. The next three options would not promise such a benign outcome, and working out the seventh option would require considerable time.

While a net present value reduction in the debt servicing cost would not mean more money for Greece to spend right now, it would greatly improve the debt sustainability of Greece.

Therefore, we advise consideration of these options, irrespective of which party will win the upcoming elections, as long as a comprehensive agreement on fiscal, structural and economic policies can be reached between the Troika and the new Greek government.

Annex: calculation method

Net present value calculations depend on many parameters. Our approach was to set-up a baseline and some alternative scenarios for Greek gross public debt for 2015-2050 and to simulate the difference between the interest payments in each year. We then calculated the net present value of the difference in the interest payments between the baseline and the alternative scenarios.

Thereby, even if our baseline scenario is imprecise, the difference between the baseline and the alternative scenarios should be reliable. The discount factors for the net present value calculation are our assumed future Greek interest rates (as we detail below).

For setting up our baseline scenario, we have updated and refined our calculations done in June 2014. That report described in detail our model.

The update includes the use of data from the November 2014 ECFIN and the October 2014 IMF forecasts and market-based data on interest rates from 5 January 2015.

The sustainability of public debt depends, apart from the initial level of debt, on

(i) future GDP growth,

(ii) the primary balance,

(iii) borrowing costs, and

(iv) non-standard revenues and expenditures.

Regarding (i) we take the IMF’s October 2014 forecast for nominal GDP growth from 2014 to 2019, which shows a gradual acceleration of growth to 5.44 percent in 2019. Similar to our June 2014 assumption, the annual growth rate is expected to decrease to 3.7 percent by 2022 and remain at that level in later years.

For (ii), we again use the IMF’s October 2014 forecast for the primary balance till 2019 (4.5 percent of GDP primary surplus in 2016-17, which then declines to 4.2 percent in 2018-19). We then assume a gradual reduction to 3.1 percent by 2022, and to 2 percent by 2030. Since in the baseline scenario the debt level is reduced to below 80 percent of GDP by 2030, a 3.1 percent of GDP primary surplus in later decades, as previously assumed, may be excessive.

For (iii), we track the interest rates of different components of the debt stock, aiming to project expected interest rates on existing and new borrowings. We note that all yields (EFSF borrowing cost, Euribor, German and Portuguese yields) have come down substantially in the past half year and their expected future values substantially declined too. This alleviates the Greek interest burden. The EFSF bond spread over the German bund declined to about 20 basis points compared to 40 basis points in June 2014.

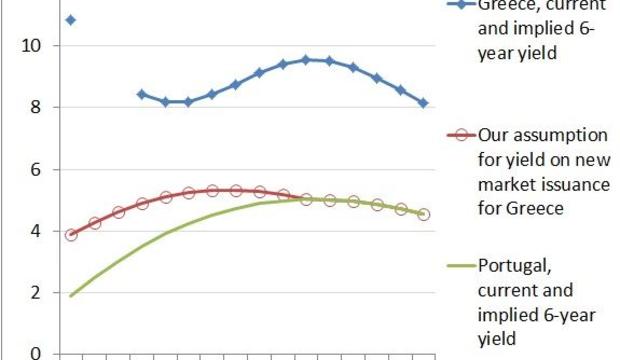

The 3-month EURIBOR futures are available only until 2020 (Figure 2) and similarly to our June 2014 paper, for later years we use the expected German one-year yield to approximate the 3-month EURIBOR, by assuming that the spread between the Euribor and the Bund remain unchanged.

In Figure 3 we show different market borrowing expectations. Since current and expected Greek yields are heavily influenced by the current financial market tensions, we do not use current Greek yields. Instead, we use the expected Portuguese yields to form an expected path for Greek yields on new market borrowing. Specifically, we assume a 200 basis point spread of Greece over Portugal in 2015 and assume that the spread over Portugal will gradually decline to zero in ten years, i.e. by 2025. From 2025 onwards, we proxy the expected Greek market borrowing yields with the expected Portuguese yields.

The reason for this assumption is that with the absence of a new Greek crisis and with a gradual reduction in the Greek public debt ratio as implied by the baseline scenario, market borrowing rates of Greece have to be much lower than what is reflected in the current term structure of interest rates.

For (iv) we keep our earlier privatisation assumptions. Additionally, we add the profit transfer from the ECB and the national central banks as it was expected by the IMF in June 2014 (see Table 2 of the main text).

Data on the expected profit transfer from 2017 onwards is not available. However, since this annual transfer amounted to about 9 percent of the end of year stock, from 2017 onwards we assume that the transfers will also amount to 9 percent of the given years’ stock.

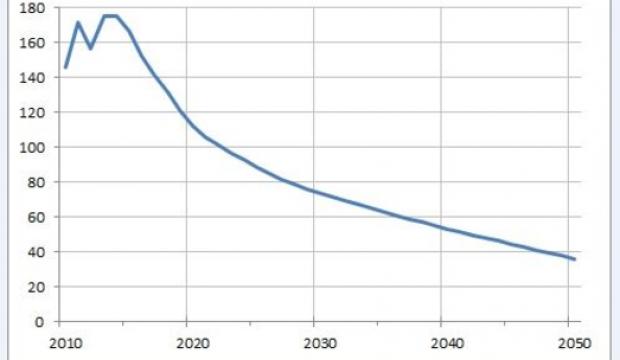

With these assumptions, the baseline Greek debt ratio scenario is indicated on Figure 4. The debt ratio would fall to about 40 percent of GDP by 2050, which perhaps may sound inconceivable. Yet as we highlighted in our paper with André Sapir and Guntram Wolff, the goal is not the calculation of a baseline scenario which best corresponds to our views, but to set-up a baseline scenario which broadly corresponds to official assumptions and current market views and to assess its sensitivity to deviations from these assumptions. Greece's debt trajectory continues to be very vulnerable to negative shocks, in which case debt dynamics would stay high or derail.

Figure 2: The current and expected 1-year German yield (2015-2030) and the 3-month EURIBOR futures prices (2015-19), percent per year

Sources: Our calculations for the German yield using the expectation hypothesis of the term structure of interest rates with data as of 5 January 2015. The source for EURIBOR futures data is barchart. Note: the value indicated for 2015 is the current yield on 5 January 2015 for Germany, while the average of the futures quotes for March 2015, June 2015, September 2015 and December 2015 for the Euribor.

Figure 3: Expected future 6-year market borrowing costs for Greece and Portugal, percent per year

Source: Our calculations using the expectation hypothesis of the term structure of interest rates with data as of 5 January 2015. Note: the value indicated for 2015 is the current yield on 5 January 2015

Figure 4: Greek public debt in the baseline scenario, percent of GDP, 2010-2050

Source: our calculations

This post appeared on www.bruegel.org/