This article is a translation of the original in Greek, published here on the author’s blog SimonKnowz.com.

The official records from the City of Cambridge, Massachusetts show that the property tax account which corresponds to a condominium owned by former Prime Minister Lucas Papademos had a lien on it for several years due to the account being in arrears. A tax lien is an involuntary charge on a taxpayer’s property giving the city precedence over other liens and (in case of liquidation) must be satisfied first.

The City of Cambridge real estate tax records show that – with few exceptions – for every tax year between 1995 to 2013 payment of the taxes due on the property were delayed, resulting in a total of over $7,000 in penalties and interest payments during that period. The records also show that the debts have now been paid and with no additional tax payments outstanding. The tax due for 2014 has been paid on time.

According to Wikipedia Lucas Papademos was Governor of the Bank of Greece from 1994 until 2002, from 2002 until 2010 Vice President of the European Central Bank and Prime Minister of Greece from the 11th of November, 2011 until the 16th of May, 2012.

In the US the property tax assessments and payments are public records available on the internet. Below are some indicative screencaps of the account which corresponds to Mr Papademos’s condominium. I have in my possession the detailed information for every year and have corresponded with the City of Cambridge which confirmed the accuracy of the records.

The lien years

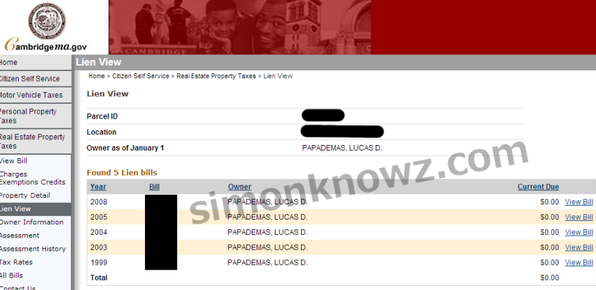

As the screencap below from the website of the City of Cambridge shows, in 1999, 2003, 2004, 2005 and 2008, the account had a lien on it due to delayed payment of the property taxes due for those years. Those years saw the highest penalties and interest payments levied, totalling thousands of dollars.

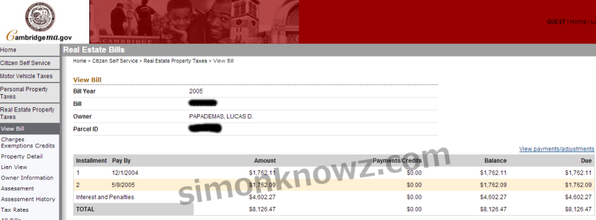

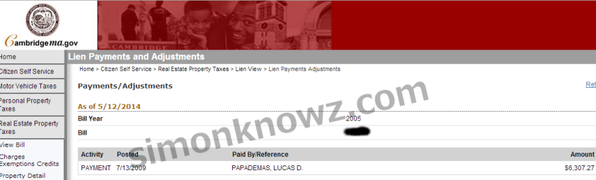

For instance in 2005, while the total tax owed was initially $3,524.20, it was paid off with one payment worth $6,307.27 which was made on July 13th, 2009.9.

In the years 2001 – 2013 when the account did not have a lien on it, smaller penalties were paid – usually on the order of $100-$200 per year given that even during those years the taxes were not paid on time but with shorter delays. In Cambridge – as is customary in the US – for every year half of the tax bill is due by the end of November of the previous year and the remainder in the beginning of May of the same year.

Delayed payments starting in 1995

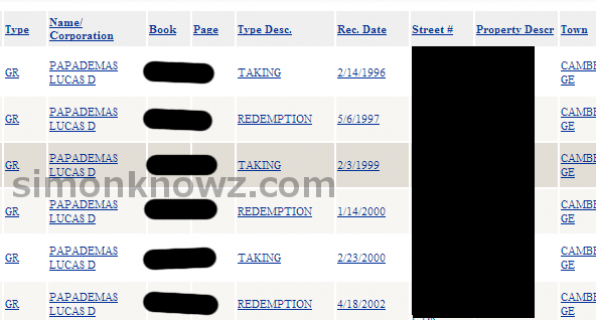

The screencap below is from the site for the Commonwealth of Massachusetts and has information for years prior to 1999. The term ‘Taking’ means that outstanding debts are registered (after a period has passed) and ‘Redemption’ that the debt has been paid off. The table below shows a summary with dates of outstanding amounts for the bills due o 1995, 1998 and 1999 (interest and penalties totalling $354.28 for those years).

As Prime Minister

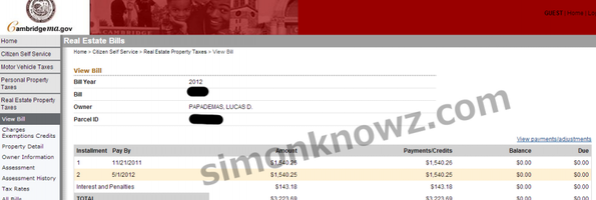

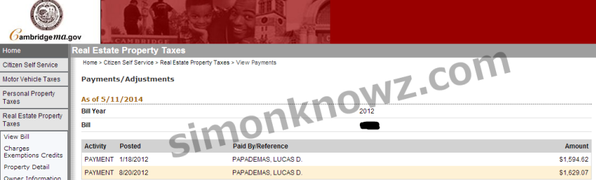

Both payments for 2012 were due during Lucas Papademos’s premiership. As the screencap below shows, both deadlines were missed (paying in January and August, 2012 as opposed to November 2011 and May 2012 respectively) with the result being an additional $143.18 in penalties and interest was paid for the tax which that year was $3,080.50.

Follow Simon here on Facebook, and follow @SimonKnowz on Twitter.