(Click here to zoom on mindmap.)

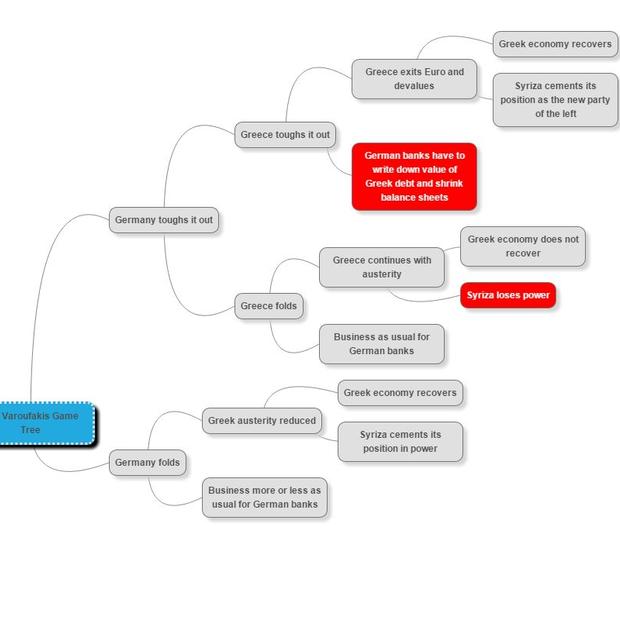

If Germany toughs it out and Syriza holds firm, Greece will have to leave the Euro. It will devalue, regain competitiveness and, Iceland-style, will start to grow again. Syriza will be thanked and considered heros in Greece. But European banks will have a harder time.

Their Euro denominated assets will take a risk-adjustment hit and they'll have to shrink their balance sheets – lend less, fewer deals to take cuts on, smaller bonuses.

So if the bankers are in charge, they'll stop that happening and Germany will fold by offering Greece a deal it can't refuse. But note that it has to be a pretty good deal given the attractions of Grexit to Syriza.

Now, the bankers aren't always in charge. German monetary rectitude is a force that even they might find hard to resist. In which case Germany does not fold, Greece exits, and Syriza is just fine – as, by the way, is Greece.

So whatever the outcome – whether Germany folds or not, Greece and Syriza do just fine. This is not a game of chicken, in which either side can get hurt if the other does not budge. Here, whatever Germany does, Greece comes out well. In game theory – as well as ordinary language – this is not chicken; it's called a dominant position.